With Unsecured Creditor Claims data you’ll gain insight into which of your customers have suffered financial losses as a result of their own customers going into liquidation or administration.

This data isn’t provided on standard business credit reports and allows you to anticipate a potential cashflow catastrophe well in advance before it’s too late!

Receive live alerts in platform for any unsecured creditor claims against your customer by simply uploading your customers via Xero, Sage Business Cloud, QuickBooks, FreeAgent or CSV.

1. How does it work?

The platform will monitor the customers in your ledger or attached CSV.

Every user attached to the ledger or CSV will get alerts.

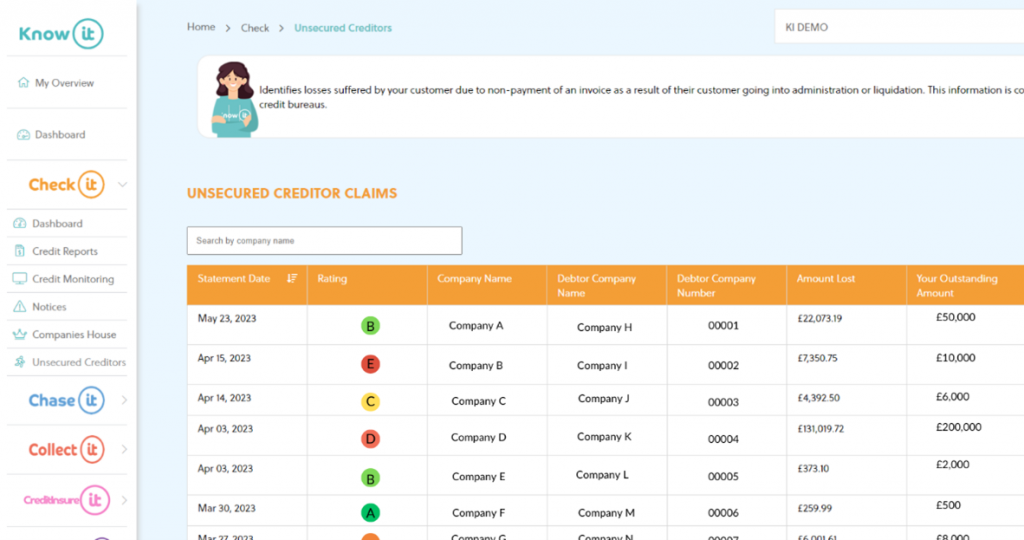

2. Unsecured creditor table

This overview includes crucial details such as the debtor company’s name, company number, and the corresponding amount lost. Additionally, users can access information about the total outstanding amount owed by the debtor. The ‘Unsecured creditors’ table provides the following information.

Statement date – This is the date when the debtor went out of business

Rating – Your customer’s credit rating

Company Name – Your customer’s company name

Debtor company name – Your customer’s debtor’s company name

Debtor company number – Your customer’s debtor’s company number

Amount lost – Amount lost by your customer due to their debtor going into liquidation or administration

Your outstanding amount – Total outstanding amount owed to you by your customer. Only be visible if a ledger is connected. If CSV, it will show as 0.

Credit Report – You can credit report your customer by simply clicking the “Use Credit” button.

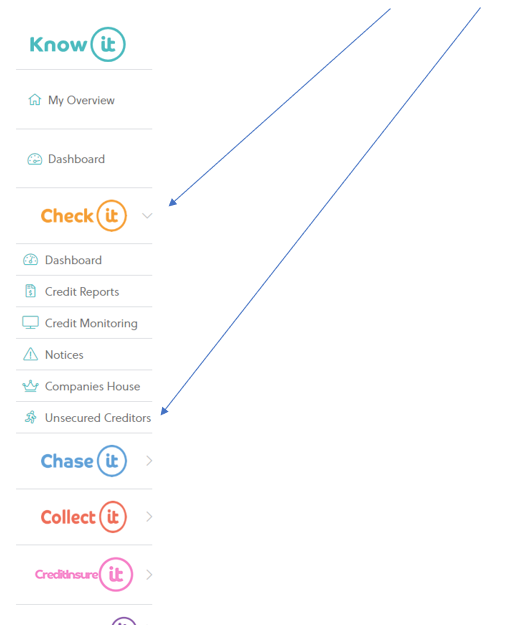

3. Where can you see those unsecured creditors

Use the sidebar to navigate to “Check-it” and then “Unsecured Creditors” from the dropdown.

On this page you will see your Unsecured Creditor Claims